Dec. 1, 2014

Dec. 1, 2014

Just what is going on with falling oil prices, and how will it affect Mexico and expats living in Mexico?

Just who is producing oil – and how much? … Who are the players?

Just which players are losing money and which ones are making money?

Will Canadian businessmen and US businessmen choose to sell oil at a loss?

Just what are Russia’s real costs? … Canada’s real costs? … USA’s real costs?

Basic Story: US oil production from the new North Dakota & Montana oil shale fields is driving down world oil prices – as the US oil boom has grown to 1.1 million barrels a day – surpassing Iran’s output.

Some news sources like the Washington Post are flogging reports of $40 a barrel oil due to “$42 per barrel” US costs – or even “$30 a barrel” Canadian costs – but these WaPo quoted “experts” really don’t fit the realities of actual US production costs.

– and that 1.1 million bbl per day for USA is just 1.2% of the world’s daily output of 92 million bbl/day. Canadians are producing 4.1 million bbl per day …

Experts on the US Bakken Shale (North Dakota) production costs instead say:

“$70 a barrel could cut production 28 percent to 800,000 barrels a day by February from the 1.1 million barrel current levels.” http://www.bloomberg.com/news/2014-10-21/oil-at-80-a-barrel-muffles-forecasts-for-u-s-shale-boom.html

Worldwide oil consumption is predicted at 92.7 million barrels per day for 2014:

http://www.bloomberg.com/news/2014-10-15/opec-finding-u-s-shale-harder-to-crack-as-rout-deepens.html

I’m continuing to drill into costs for various countries – since sovereign oil volumes still dominate the world wide markets, but here’s what we’ve found so far:

The costs for Russia, Nigeria, Iran, Venezuela, and the Gulf States et al are often described as a cross-product of their production costs per barrel AND their net government spending of oil$$ to pay their government expenditures.

IMF reports the following government break-even / balanced Federal budget costs due to heavy oil subsidies to prop up their economies:

Mexico: $79 a barrel NYMEX price (32% of Federal Govt. revenues)

Iran: $136 (25% of Federal Govt. revenues) – production down 50% since 2012 to just 1 million bbl/day

Venezuela: $120 (25% of Federal Govt. revenues)

Nigeria: $120 (75% of Federal Govt. revenues)

Russian: $101 (50% of Federal Govt. revenues) – $90 billion in 2014 currency reserve losses

Saudi Arabia: $91 a barrel Brent price

Kuwait, Qatar and the United Arab Emirates balanced budget $$ are at about $70 a barrel.

Canada: “One in four new Canadian oil projects could be vulnerable if oil prices fall below US$80 per barrel for a extended period of time, according to the International Energy Agency. The Paris-based agency said that “…in terms of production with breakevens exceeding $80/bbl, Canadian synthetics projects have the highest percentage of production of the types examined here (about 25%) that would fall into a negative net present value if there were to be an extended period of prices below that level.”business.financialpost.com/2014/10/14/canada-oil-prices-iea/?__lsa=41c3-bd04

Canada continued: “According to a study by Scotiabank of more than 50 plays across Canada and the U.S., Western Canadian plays — including those in the oil sands — cost less to produce on average than plays in the U.S. such as the Bakken in North Dakota, and the Eagle Ford and the Permian Basin, both in Texas.”

These Canadian oil BUSINESS data points are significant, because Canadians produce 4.1 million bbls per day – almost 4X more than the USA or Iran or Libya.

===================

Quick Conclusions:

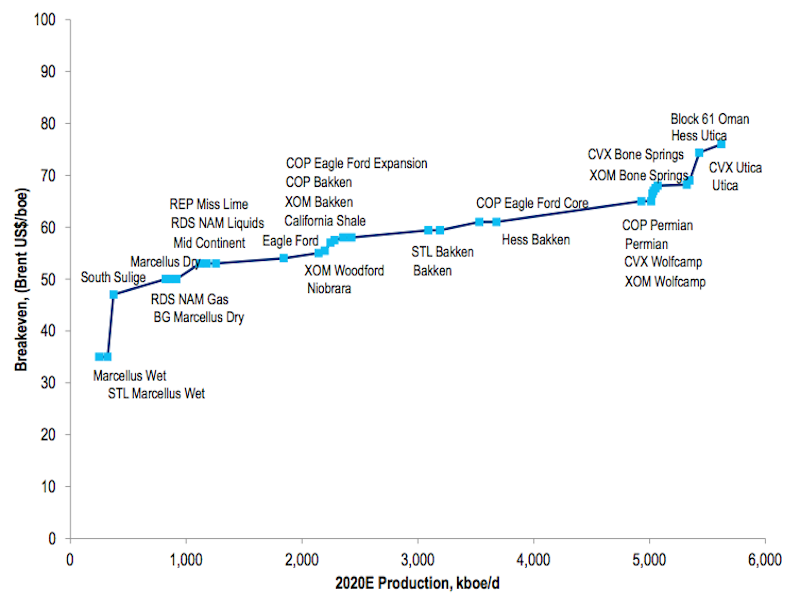

At the $65 a bbl for NYMEX crude, we are approaching the point where US and Canadian oil producing companies cannot be profitable (see the top plot) – and they have said they will cut their output until prices recover…

In the meantime, the Saudis, Kuwaitis, and Gulf States have both oil reserves and currency reserves to tolerate $70 a bbl oil – while the Russians and Nigerians and Mexicans can effectively devalue their currencies vs. the US dollar by continuing to pump and sell oil at a loss versus their Federal budget needs + production costs – as long as they can fund their deficits – just like the US public Federal Govt debt is over 100% of GDP… just borrow more $$ now, print more $$ now, and hope to pay it back in the future…

Nigeria, Venezuela, and Iran are really screwed by this continuing…. but they can’t afford to stop selling oil – even when selling it at a loss.

… Overall, we may be near – or at the bottom (floor) of falling oil prices…

Why? While some governments willingly sell millions of barrels of oil at a loss, … US businessmen and Canadian businessmen will likely not sell at a loss –

and US and Canadian average costs simply will NOT tolerate $60 a bbl of oil – and $80 a bbl prices better fit the US & Canadian Capitalist’s realities:

or … Will desperate governments continue to sell oil at big losses, in failed efforts to temporarily prop up their revenues ? … lo no se …

IMPACTs ON MEXICO

The US dollar continues to strengthen as oil prices fall – due to Mexican Govt. PEMEX losses of revenues – but since the Mexican Govt. has established its spending amounts based on $79 a bbl of NYMEX crude, we will likely see a weaker MXN peso as long as oil prices stay below $79 a bbl.

Coincidentally, $80 a barrel is the typical NYMEX crude price that American and Canadian producers need to make profits, so, smart thrifty expats in Mexico could decide to buy your pesos now – while oil prices are below the $80 a bbl benchmark….

As always: Yucalandia offers information from others as entertainment, and we do not offer legal or investment advice. Talk with a qualified professional when making important decisions.

* * * *

Feel free to copy while giving proper attribution: YucaLandia/Surviving Yucatan. ©Steven M. Fry

Read-on MacDuff . . .

Pingback: Will Oil Prices Continue to Fall…? Effects on Mexico? | Surviving Yucatan

I live atop the Utica and Marcellus formations here in northeast Ohio. The big holdup is a lack of pipelines to take the product to the refinery. Our local gas/oil fields have been in the Clinton formation most of my life, a dry gas formation that was clean enough to use right out of the ground. A great many homes here are heated from a well in the back yard. The oil has been trucked away. The new play is wet gas that has to be refined. It is a horse of a different color. The wet gas has standard gas but also hydrocarbons that in the past were refined out of oil, today it is extra cheese from the gas production and it is much more valuable than the old crude oil. The kicker is that it is just getting started. There are hundreds of wells drilled, few online because of the lack of pipelines, this stuff can not be moved in a truck. In North Dakota they are flaring off the gas to get at the oil, bad practice but common.

The real difference in this whole thing is directional drilling. I was an oil field fracker back in 82, fracking is nothing new. The new thing is drilling a hole horizontally through the formation for a mile or so and fracking that bore 50 times. In my day we fracked the bottom of the hole and went home-one frack job per bore hole. The new method costs more per well but they get at a lot more oil. The kicker: old fields that we would consider petered out are going to get re-drilled because the old method left most of the product behind. And we already know what is there because we have the logs and mud sample records.

The oil sands might have trouble at 70-80 a barrel. Oil/gas that has to be pushed a long way might have problems at sub one hundred prices but product like what is being developed here in Ohio is cheap once the pipeline right-of-ways and construction is completed.

As to the peso, Mexico has a lot of oil/gas on its mainland as well as off shore. The drilling rights on dry land are a problem in Mexico because the landowners get zilch. My Mom&Day pulled a 60 grand check just for the right to look for oil on their 15 acres. The Utica is 600 feet thick under their place. Drilling Mexico’s shale will require a different way of paying the land owner than today’s, ” it’s mine all mine” refrain of the Mexican government. Sixteen pesos to the dollar if the oil price goes to $60.

Well maybe 16 was too much of a reach…