July 6, 2025

A fun tax question has come up on FB forums for foreigners from the USA … regarding how much taxes the USA-nian owes to Mexico on USA-sourced income … Plus, we have added a section at the end of this report describes how US Social Security (and other Govt. pensions) are taxable by ONLY the USA, while private pension income from the USA are taxable by both the USA & Mexico.**

WHEN the USA-nian qualifies as a Mexican Resident (under Mexico’s ISR tax-home residency rules) … then, even though the taxes paid in the USA are credited against the Mexican taxes owed (eliminating any “double taxation”**), the USA-nian resident of Mexico can still owe taxes on their US income … especially if the USA-nian is a high-income earner.**

Typically, if you have income from the USA that totals more than about $80,000 annually, the top tax brackets of Mexico can have higher % tax rates than the USA – so the taxes you pay in the USA may not cover the difference of the higher taxes owed to Mexio, as a high earner who is a resident of Mexico.

**It’s worth first noting the basic principles of the 1992 USA-Mexico Tax Convention (“Tax Treaty”):

1. No Double Taxation … Any US dollars paid to the US IRS are credited against any MXN pesos owed to Mexico’s Hacienda/SAT … and vice versa … Taxes paid to Mexico are credited against any US taxes owed.

2. All tax deductions, all tax-deductible expenses, all tax exemptions and tax waivers by the US IRS are “allowed” … accepted … by Mexico’s Hacienda/AST … and vice versa … the US IRS accepts / “allows” all of Mexico’s deductions, waivers, & exceptions.

3. Both Mexico and USA charge their “residents” taxes on world-wide income. Whatever $$ you earn anywhere in the world … are taxable by Mexico AND the USA … when you are a “resident” of Mexico or the USA.

Mexico’s Top Tax Rate Exceeds the USA’s tax rates for most USA-High Earners:

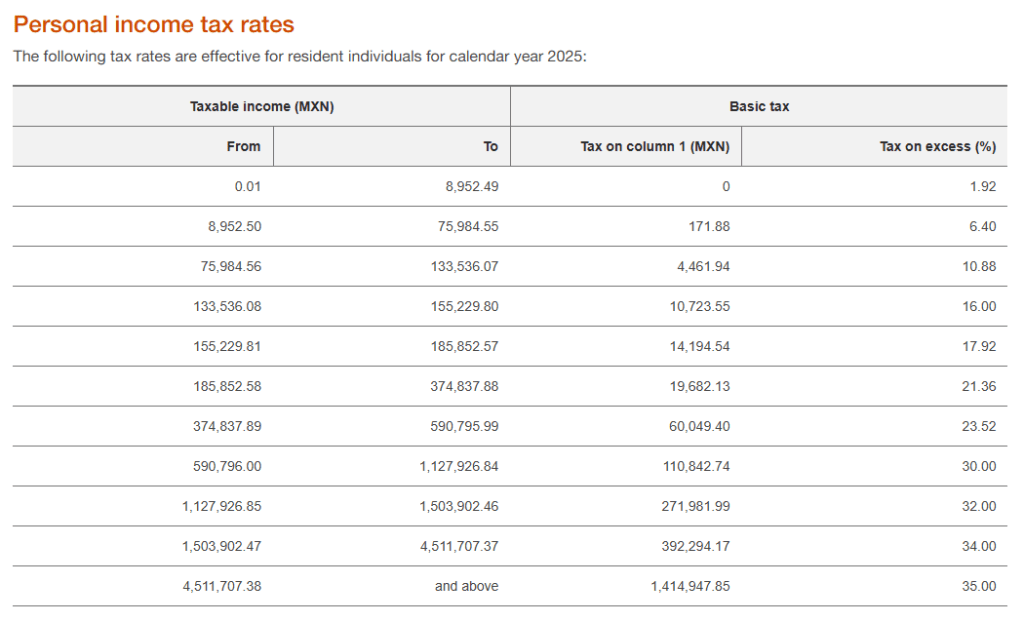

Mexico’s top marginal rate is 35%.. Mexican “residents” (residency is defined by the Mexican ISR) are taxed on worldwide income, while non-residents are taxed on only Mexican-source income.

IOW … IF you are a resident of Mexico, based on tax code definitions, then you CAN owe taxes on US based income that has been taxed in the USA at rates less than 35%. …. and Mexico’s 30% tax rates for “residents” are triggered at just $30,000 USD of net taxable income after deductions … (See Mexican ISR Tax Table below.)

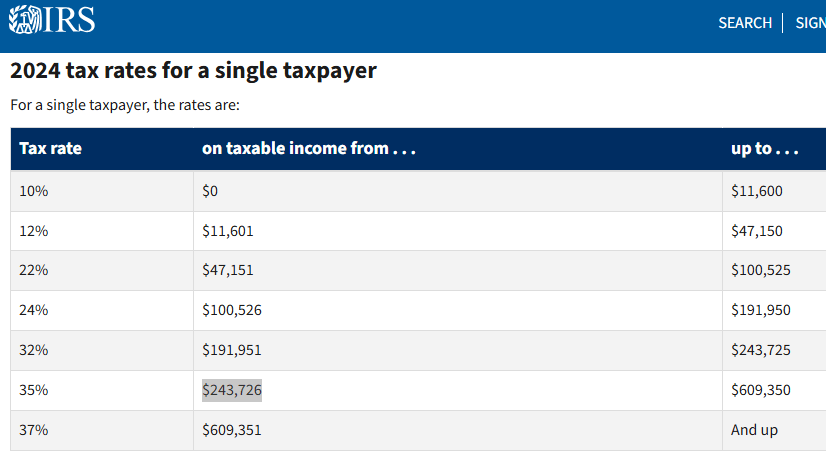

By comparison, the US IRS triggers 32% taxes ONLY above $192,000 USD … so many higher*income US-anians living in Mexico as “residents” … DO also OWE MEXICAN income taxes, after they have paid their US taxes

…

Example … any US taxable income total that’s less than $243,726 USD (when USA’s 35% rates kick in to equal Mexico’s top 35% rate) then part of that high-income can also be taxable by Mexico.

Example…

**A US income of $100,525 (after deductions) is taxed at just 24% by the USA … while Mexican rates on that income are 34%.

… As a RESIDENT of Mexico, (determined by Mexico’s ISR rules) a high-earner would owe Mexico the difference … of net 10% income taxes

=> owing $10,052 USD in taxes to Mexico … and $24,126 to USA.

Mexican Tax Table Rates by Income

https://taxsummaries.pwc.com/mexico/individual/taxes-on-personal-income

and

US Income Tax Rates

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Social Security Retirement Benefits:

What USA Pension Income is Taxable in Mexico … and Which Pension Income is Exempt:

US private pension is taxable in Mexico, along with being taxed by the US IRS, meanwhile Government paid pension income from the USA is exempt from Mexico. The “savings clause” in Article 1 of the treaty describes how the US applies its laws, not withstanding the treaty in most cases.

The US IRS taxes the world-wide income (with some exemptions) of its citizens and green-card holders regardless of residence. With a private pension, USA citizens in Mexico, may owe taxes in Mexico. First, compute the tax due in the US, and then use Form 1116 to claim a Foreign Tax Credit against US taxes for the pension tax paid to Mexico.

Cheers …

Dr. Steven M. Fry

* * * *

Feel free to copy while giving proper attribution: YucaLandia/Surviving Yucatan.

© Steven M. Fry

Read on, MacDuff.