Updated 2/17/2025 … Original August 19, 2022:

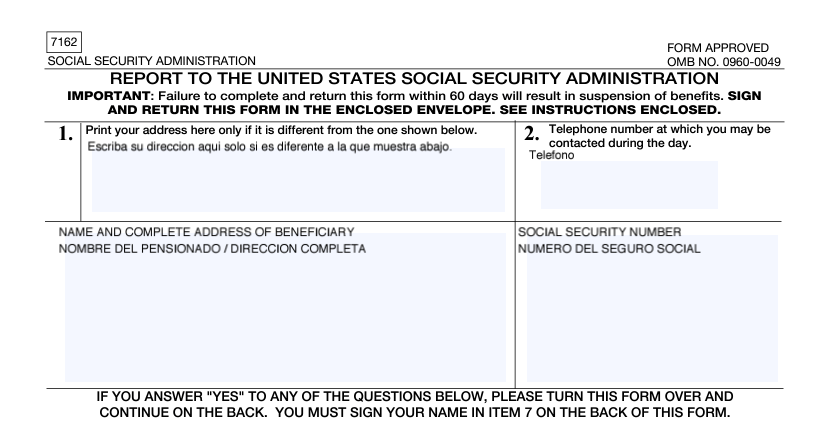

The US Social Security system requires all people receiving Social Security benefits who are living abroad*, who have a foreign address, to file a form SSA–7162 every year in July or August. Fortunately, SSA Form 7162 is a simple form that certifies our current address, and certifies that the SS benefits recipient is still alive.

https://www.ssa.gov/foreign/ssa7162ocrsm.pdf

Note that you can use a pdf-filler program to type in your official foreign address into the second row of boxes:

Here is another version:

https://uploads.mwp.mprod.getusinfo.com/uploads/sites/52/2022/02/ssa-7162-REVISED.pdf

Notice how this version of the form 7162 shows where to type in your Name, Address and Social Security number.

*Who is required to file?

All people receiving Social Security benefits, who have foreign addresses registered with the SSA are required to file. It does not matter if your check is deposited in the USA or to a foreign bank account, because it’s all about the mailing address you have on file with the SSA.

*2022 Updates:

The SSA typically mails the forms out in May each year, with a 60 day due date for returning the form after the day your receive it … Yet the program was suspended due to COVID mailing problems, and this year, the notices were not sent out until June 2022, A follow up notice is sent in October and December if the completed questionnaire has not been received.

https://es.usembassy.gov/foreign-enforcement-questionnaire/

* * * * * * *

For USA-nians on Social Security living abroad. who have not received their notice in the mail, just download the SSA’s pdf form for SSA–7162,

https://www.ssa.gov/foreign/ssa7162ocrsm.pdf

print a copy, complete the form, and mail it back to the USA using registered Mexican mail, to:

Social Security Administration

P.O. Box 7162

Wikes Barre, PA 18767-7162

USA

2024 UPDATE to Where You Send/Deliver Your Form:

Prior the Biden Presidency, SSA offices were better staffed and SSA benefit recipients living abroad could simply drop off their annual SSA-7162 filings at any SSA office. Under last year’s Biden short-staffing issues, the SSA interoffice mail service stopped working, and SSA systems stopped reliably delivering our SSA-7162’s to WILKES BARRE, PA, causing some people’s benefits to be inappropriately suspended … So be sure to mail your form to the WILKES BARRE, PA SSA office.

SSA Official Due Dates for Filing in 2022:

Per the SSA: “The Social Security Administration will resume mailing the forms SSA-7161 and SSA-7162 in late June 2022.”

https://form-ssa-ocr-7162.pdffiller.com/ and

https://www.ssa.gov/foreign/

~ We personally received our SSA 2022 notices with our form SSA-7162’s on July 17, 2022 here in Merida, Yucatan … and DESPITE WHAT SOME INTERNET POSTERS SAY, the form clear says:

“Then, complete your report and return it to the Social Security Administration, P.O. Box 7162, Wilkes-Barre, Pennsylvania, 18767-7162, U.S.A. in the enclosed envelope within 60 days from the day you receive it. “

https://www.reginfo.gov/public/do/DownloadDocument?objectID=7143601

NOTE to READERS:

There are multiple legitimate workable ways to get your SS Form into the US Postal Service mail, to get to the SS Wilkes Barre office well before the SS’s Dec. 15 deadline.

NOTE to READERS:

There are multiple legitimate workable ways to get your SS Form into the US Postal Service mail, to get to the SS Wilkes Barre office before the Dec. 15 SS deadline.

1. You can use very expensive DHL or Fed Ex to get your USPS stampled letter to the SS, delivered to a friend or family member in the USA – and trust them to make a special trip, STAND IN LINE at a US Post Office … to send it by Registered or Certified mail.

2. Go into any Mexi-Post office and mail the letter to the SS Wilkes Barre address, using REGISTERED / CERTIFIED Mexi-Post mail. … This service works VERY WELL … and is cheap … and takes about 2 weeks … and while Mexi-Post delivery of things coming INTO Mexico (or to your house), instead Mexi-Post of OUT-GOING registered/certified mail TO the USA works well – and Mexi-Post’s outgoing mail goes straight to the USPS. 😉

AND the US Government accepts the Mexi-Post certified reception dates – as proof that you mailed it by certified mail.

AND the US Government accepts the Mexi-Post certified reception dates – as proof that you mailed it by certified mail.

3. Use a trusted human here, to personally mule your mail to the USA, and to put your application into the US Mail with plenty of time for delivery … Costs about 50 cents. Yucatan Mule Connection works well.

.

BECAUSE we each have a 60 DAY GRACE PERIOD for mailing in your Form 7162 … it’s hard to see why expensive Fed Ex or DHL is needed

… unless a person screws around from July until December … and then expensive DHL to a friend or family member becomes necessary … and for them to mail the Form 7162 by USPS Express Mail delivery before Dec. 15 …

???

Why explain all of this?

There are a number of official sounding reports & posts on expat social-media forums claiming that we must file the forms every May, or supposedly risk losing our benefits.

Fortunately, the SSA’s official announcements clearly explain the actual US Govt. policies.

Happy Trails

Read On … MacDuff !

Interesting.

I believe this only applies to those that have SS deposit funds to a non USA bank, or mailed to a non USA address.

As the article specifies, it is only needed if your official address on file with SSA is abroad.

People living abroad using USA addresses & USA bank accounts, are not recognized as needing to file.

Obviously if they have their check is deposited abroad, the SSA has required people to register a foreign address.

I would like to know if is Ok (or legal) of using my US address and my US bank account with SSA while living in a foreign country. Thank you.

Yes, that is fine.

Each year some beneficiaries are required to complete the Form SSA-7161 or SSA-7162 beneficiaries are required to complete the Form SSA-7161 or SSA-7162—From the US Embassy form.

I’ve been doing this online for a few years now, as mail doesn’t come to Tixkokob. Thanks for the heads up though, as always.

Jerry, How do you return your Form SSA-7162 to the U.S.? Is there an alternative to mailing it such as online via email or Via Fax?

i think this could be don a better way, i live in Thailand, it takes mail from the USA 30 days to get to my house, which leaves me 30 days to mail which there mailing system does not work well, There is NO DHL, or other services , i mailed my last 7162 in july still help up a the united states arrival @ inward of exchange, i Track it with EMS Thailand postal service, still no has picked it up,

Neil e Vanslyke

Me and my chidlren have not received yet. It is the 2 week of December. Been calling SSA and even reported it to the OIG of Ssa. Hope I get them soon. Does anyone have any suggestions to help me get pir 7162 and 7161

Try this:

https://cr.usembassy.gov/wp-content/uploads/sites/248/ssa-7162-REVISED.pdf?mc_cid=5a7d134dc3&mc_eid=%5bUNIQID%5d

Thank you Sir for the information will try this.

Thank you for all you help. Wanted you to know. A few hrs after reading your message. And receiving the form you sent us.

After calling the Ssa OiG Ssa last night we received the form you sent us. Plus the forms for our 3 and 4 year old children. In email from FBU.

We will be filling them out and sending them a letter of all the problems we have had with Manila FBU. When I came here in 2016 to stay after a few visits to meet my wife and sell my house back in the USA. Manila use to answer there phone during all working hrs. Up to Covid19. I live Davao city. We don’t use Qr codes anymore and facemask are optional. The email of FBU just a few months ago went up from 5 or 7 days. To 15 days. On the birth of our first child in 2018. We called ssa Manila the case worker gave us a appointment. However when we got there. She was not there one employee told is she was in cebu at the couslet office another told us she was sick. We asked for a supervisor and they said none arable sire they did some of the work they could do. Our appointment was at 8am. The6 could not get to is tell 11 am. Thos is with a 2 month old baby and I am diabetic. They also did not inform us that we had to go to passport services first to report birth from abraod from the start. The trip cost is around 700 usd with hotel stay and meals. However it cost us another 700 usd to go make a appointment with passport services. We will certify register mail on these fos and hopfully not get cut off . I really do thank you for you help. And caring. We do not touch our children money we lock it up in time shares some php time shares. And some usd time shares. I just wanted to keep you updated you are very helpful. Hope you and your family have a great holiday season.

I sent my SSA-7162 form to SSA in Wilkes Barre, PA. Usually I send it to FBU Manila and when I mentioned that to them in Manila they replied that they had no information about it being received in Wilkes Barre. I am concerned about my benefits being stopped. I have the SS benefit checks sent to my Bank of America account in the U.S. so why do I need to submit the SSA-7162? Other American friends who live nearby tell me that they do not have to file that annual report. Thank you. James Madden

Hi James,

The other Americans seem to be unaware of the Biden Administrations rule changes last June, 2022. Since you can lead a horse to water, but can’t make him drink … then trying to get your USA-nian cohorts to follow rules, seems a little pointless ??

If you are living overseas, then the law is clear,

“It does not matter if your check is deposited in the USA or to a foreign bank account, because it’s all about the mailing address you have on file with the SSA.”

Rather than using FBU offices, why not just follow the SSA’s official instructions?

“For USA-nians on Social Security living abroad. who have not received their notice in the mail, just download the SSA’s pdf form for SSA–7162,

Click to access G-SSA-7162-OCR-SM-1.pdf

print a copy, complete the form, and mail it back to the USA using registered Mexican mail, to:

Social Security Administration

P.O. Box 7162

Wikes Barre PA 18767-7162

USA “

???

Cheers, Steve

Thanks Steve

I filed last year, but so far this year nothing has arrived by 2July2024. SSA-7162 cannot be downloaded, according to a screenshot from the SSA.gov site, https://www.ssa.gov/forms/ >search ssa-7162, which your blog will not allow me to paste.

Did you open the pdf file for the form 7162?

Click to access G-SSA-7162-OCR-SM-1.pdf

THANKS! Your link worked (while searching their site was futile).